Growth Channels + Outlook

Sales + Marketing

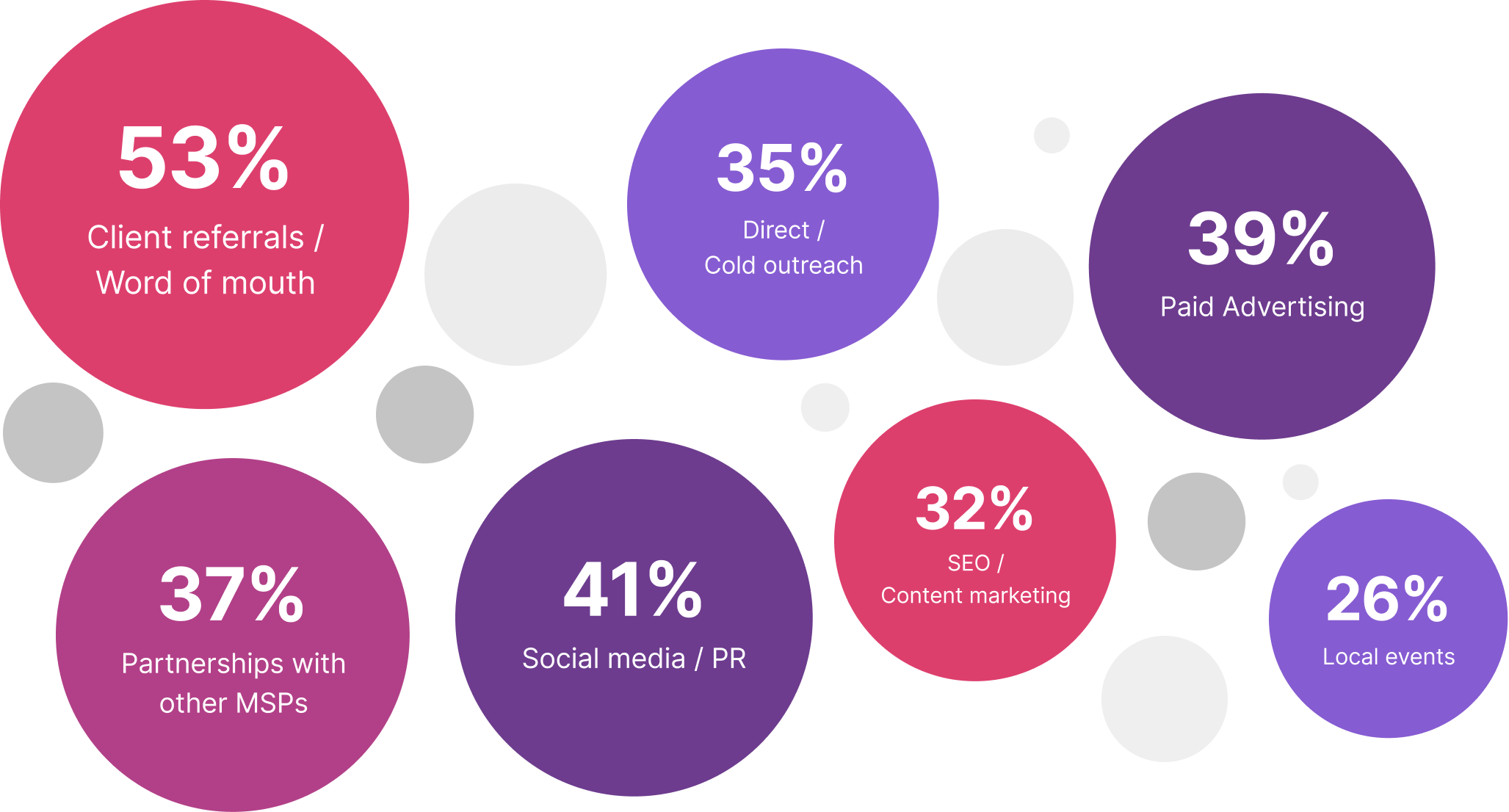

Word of Mouth Continues to Drive Growth — But Not All Acquisition Channels Are Created Equal

Low CSAT May Increase Marketing Costs

Most Successful Growth Channels

MSPs Report Sales Capacity Gaps — But Marketing Could Help Bridge the Gap

Most MSPs employ someone they consider a dedicated sales staff member, with just 9% reporting none at all. Larger MSPs are likely to have 10+ salespeople, while smaller MSPs typically operate with 0–5.

Small and early-stage MSPs tend to feel the pinch of fewer salespeople: small MSPs are more likely to cite limited sales capacity as a top barrier to growth, while younger MSPs (those that have been in business for 3-5 years) are more likely to say that a lack of upsell and cross-sell is a top growth challenge (which is often a function of sales staff). These concerns about selling capacity and focus may explain why sales roles rank among the top positions MSPs plan to hire for in 2026.

Marketing investment decisions appear closely related to sales capacity. Smaller MSPs are more likely to rely on social media and PR as primary growth channels, using broad, organic reach to attract (rather than actively pursue) leads. On the other hand, Medium and large MSPs are more likely to cite cold outreach as a top growth channel — which is usually led by salespeople — and tend to invest in paid advertising to generate leads for the sales team to pursue. MSPs struggling with adding headcount should ensure their marketing investments complement their sales capacity.

Number of Sales Staff

Growth Outlook

Shrinking Budgets, Rising Costs, and Growing Competition Considered Top Growth Hurdles

MSPs predict their biggest hurdles to acquiring new customers in 2026 will be shrinking client budgets, being underpriced by competitors, and too much competition. While MSPs often view commoditization and market saturation as their biggest sales hurdles, these challenges can often be tied to unclear ideal customer profiles or points of differentiation. Without specific targeting and value propositions, charging premium prices and winning new clients becomes more difficult — no matter what market conditions are.

Overall, MSPs say their biggest growth concerns are reduced client budgets due to economic uncertainty, keeping pace with AI, and rising labor costs. While investing in new technology or headcount may be seen as risky investments in a volatile market, many of the top-performing MSPs are effectively adopting AI and hiring new technical or sales roles in 2026 — suggesting that confidence in long-term growth (and not short-term conditions) should guide MSPs’ investment decisions.

Top Client Acquisition or Expansion Challenges for 2026

Top Overall Growth Challenges for 2026

MSPs To Prioritize Efficiency, Customer Experience, and Strategic Consulting in 2026

MSPs’ top priorities for 2026 are improving operational efficiency, enhancing the client experience, becoming strategic partners to customers, and expanding their service offerings. Given that Customer Success practices and vCIO offerings are linked to better performance, focusing on the client experience and strategic partnerships are solid investments for the year ahead. While introducing new offerings was a top-reported growth driver (Chapter 1), MSPs may want to first consider how stronger internal operations can support their ambitions to scale service delivery.

Priorities do vary by size. Small MSPs are more likely to focus on updating their business model, while mid-sized MSPs tend to prioritize expanding service offerings.

Across the board, staffing remains a key focus area: about a quarter say both upskilling employees and finding specialized talent to support new services are priorities for 2026 (MSPs with higher utilization rates are especially likely to cite these as key goals). Since 26% of MSPs say they lack enough staff to take on additional clients, MSPs must explore ways to manage workloads and headcount in the face of rising labor costs and competition. Given that many MSPs see AI taking over roles (or parts of roles) as noted in Chapter 2, MSPs would be wise to explore where intelligent automation can supplement capacity or knowledge gaps.

Top Priorities for 2026

Future Industry Outlook Is Mostly Optimistic, Despite Key Challenges

When asked about their general sentiment towards the future of the MSP industry and its growth prospects, 87% are either “Very” or “Somewhat” optimistic — suggesting that despite the challenges, MSPs still see strong opportunities for growth.

However, certain groups feel less positive. Lower-level, customer-facing employees are more likely to be only “somewhat optimistic.” Small MSPs are also more likely to feel neutral, indicating they may be experiencing competitive and economic pressure more acutely than others.

Several groups tend to have a more positive outlook: those with high customer satisfaction, a focus on compliance offerings, and effective AI adoption are more likely to be highly optimistic — indicating that strong customer relationships, the right service mix, and adapting to new technology can instill MSPs with a sense of confidence in their future.

Maturity Insights

From Startup to Scaleup: Key Focus Areas by MSP Age

Where should your MSP focus as your organization matures? Here’s a guide to understanding key organizational challenges at each stage and which areas to focus on as your business evolves.

| New MSPs (0-5 Years) | Scaling MSPs (6-15 Years) | Mature MSPs (15+ Years) | |

|---|---|---|---|

| Growth Channels | Younger MSPs are more likely to use a range of digital marketing channels to grow instead of relying on sales, since many don’t have a dedicated team. They haven’t yet built a strong base of recurring revenue, which can jeopardize growth without a concerted effort to make income more consistent. | Scaling MSPs tend to use paid marketing channels, like ads, to drive their growth. They’re also not afraid to leverage partnerships to fill gaps in service offerings as they grow. As a result, they often see good rates of increasing year-over-year revenue, which can help fuel future expansion. | Older MSPs have more sales staff to drive growth and use in-person connections (referrals, word-of-mouth, and events) to build a solid base of recurring revenue clients. They still feel challenges with sales and marketing, so optimizing their spend and resources better could drive efficiency. |

| Staff | While new MSPs tend to have better utilization rates, they may struggle to keep staff because of constraints around labor costs. They are more likely to focus on hiring sales and security specialists in the coming year – but full-time sales roles may be premature. | Scaling MSPs tend to have good staff utilization rates, but they can lack leadership in key roles in the C-Suite (like Finance, Marketing, and HR). They may find increasingly complex technical requests killing productivity if staff aren’t well-trained. | Mature MSPs tend to have higher utilization rates — and should keep an eye on potential staff burnout. They’re more likely to plan to hire salespeople and security specialists to fill in gaps, but may want to explore operational efficiency measures in tandem. |

| Customer Success | Younger MSPs tend to do well when it comes to driving client retention, but they may struggle with low CSAT scores as they work out kinks in their process. They also tend to struggle with upselling or cross-selling their clients, which may limit their customers’ success and their bottom line. | Scaling MSPs tend to focus on formalizing account management to keep the client experience more consistent. They also tend to have more mature processes for client reporting, budgets / roadmaps, and QBRs — but can struggle with churn as they figure out their niche. | They usually have formalized account management, QBRs, and long-term budgets / roadmaps for clients, and often have high CSAT. But they can also have high client churn rates, and they often cite budgets as an issue — suggesting they must balance their own growth goals with client affordability. |

| Service Approach | New MSPs are more likely to lean into a consultative service approach with clients — but they can still struggle with slow response times as they establish their processes. To scale their business, they must balance service delivery speed with client advisory. | Monitoring and maintenance tend to be their “bread and butter” services. While they’re often expanding their services, they can struggle with compliance, security, and data breaches — which are important to manage to earn client trust. | Mature MSPs sell a more diverse range of services, including more diverse compliance offerings. They want to be a strategic partner to clients, but often have efficiency issues when it comes to scaling compliance and GRC across their client base. |

| Operations | New MSPs lack robust metrics tracking — making decisions on instinct versus data. They can struggle with knowledge of their clients’ tech stacks. Consistent reporting, documentation, and staff training protocols should be prioritized. | Scaling MSPs are more likely to rely on AI to streamline operations and automate complex tasks so they can scale. However, overreliance may cause them to miss the big picture, since top performers tend to use AI more selectively. | Mature MSPs often have financial and operational metric tracking locked in — but they can struggle with integrations and lagging AI adoption. Operationalizing their tech stacks and standardizing AI usage could improve efficiency. |

What Top Performers Do Differently

Top performers are more likely to say their biggest concerns for 2026 are economic uncertainty and reduced client budgets. In response to this, they’re embracing a two-pronged strategy, being more likely to focus on both net-new client acquisition and expanding existing customer accounts to drive growth. Their top channels to land new clients are traditional cold outreach, word-of-mouth, and client referrals.

They’re also more likely to say they want to expand vCIO services and become a true strategic partner in 2026, proving that client advisory services can offer far more growth potential than simply introducing new service offerings alone can.